Warning! Pacific Financial Derivatives LLC has no relations to the scam broker PFDMarkets

LoginForex Introduction

What is Foreign Exchange?

Foreign exchange (Forex or FX) is the cross-country exchange of currencies and is, single headedly, the largest and most liquid financial market in the world. With an estimated $3.5 trillion in currencies traded in a single day, it eclipses the trading of other types of commodities. Unlike other commodity trading, Forex has no centralized exchange and is traded primarily through banks, brokers, dealers, financial institutions and private individuals. Due to this ability for financial institutions to trade Forex, the Forex market is open 24 hours, 5 days a week.

Prior to the late 1990’s, forex trading was only the practice for institutional traders and even though retail traders had access to trade the Forex market, only recently has it become popular and more common for individuals to trade Forex for profit.

Most of the world’s different country currencies are free floating; meaning they retain an individual value and will appreciate and depreciate against other currencies. Currencies are always listed in pairs as they need another currency to benchmark against.

Why would I trade Forex?

Trading Forex has many purposes and you'll be surprised of the many levels traded that impact you and you're not even be aware of it.

For every purchase you make, the contents, ingredients, by-products, parts or materials may not necessarily be from a domestic source. It could have been bought internationally and as such the exchange of foreign currency would have had to be taken place.

From a financial perspective, some people may trade the Forex market for profit. By taking a cross currency pair, they may exchange currency to a foreign designation hoping for domestic currency values to depreciate, thus when you convert it back you will receive more than you initially started.

For international importer or exporter of goods and services, there are great opportunities by having access to the international market. However, with fluctuating international currency rates, payment can sometimes be difficult. Initially companies make a sale for an agreed price, then on the day of payment the agreed value is significantly less than agreed to, due to a currency fluctuation is known as "foreign exchange risk".

You will find all types of businesses, from large financial institutions to small retail freight forwarders will practice foreign exchange hedging. Simply put, these companies will put in place measure to ensure that their agreed payment value will represent the same value at the day of payment regardless of currency value fluctuations.

The Eight (8) Major Currencies

Internationally, there are eight (8) currencies that are traded more than other currencies. These are often referred to as “Majors”. These currencies are:

| 1. | USD | Unites States Dollar |

| 2. | JPY | Japanese Yen |

| 3. | GBP | British Pound |

| 4. | CAD | Canadian Dollar |

| 5. | EUR | European Currency Unit |

| 6. | CHF | Switzerland Dollar |

| 7. | AUD | Australian Dollar |

| 8. | NZD | New Zealand Dollar |

Certain parts of the world have part of their Saturday to trade, as it's still Friday in other markets.

Financial institution in these countries may be dealing with the Forex market during their work hours - the Forex market is open and trading 24 hours, 5 days a week.

How do people make money from Forex trading?

Individual (retail) traders will look to trade currency pairs by holding currencies that appreciate and converting their holdings to other currencies to avoid depreciation. However, in recent times there have been financial products developed to make money in both rising and falling markets.

These structured financial products are known as contracts and through your broker like PFD they are accessible for you to trade. Through your broker, you will have access to BUY or SELL such contracts for profit. You will not be physically buying or selling these contracts, you are executing an order to process.

The position taken to make money from an appreciating currency is a BUY order. The position taken to make money from a depreciating currency is a SELL order.

What is a currency pair?

Currency is always measured against another currency and they are referred to as currency pairs. Currency pairs are generally segregated into groups. These groups are known as Majors, Minors and Exotics. Major currency pairs are generally the most popular traded currency pairs.

Almost all currencies are free floated, meaning that they don't have a set representation of value to another currency and can rise and fall in value independently.

The currency pairs offered by PFD available for trading are:

| Major pairs | |||

|---|---|---|---|

| EUR/USD | USD/JPY | GBP/USD | USD/CHF |

| AUD/USD | NZD/USD | USD/CAD | |

| Minor pairs | |||

|---|---|---|---|

| EUR/GBP | EUR/CHF | GBP/JPY | EUR/AUD |

| AUD/CAD | EUR/JPY | CAD/CHF | GBP/CHF |

| CHF/JPY | EUR/NZD | AUD/NZD | EUR/CAD |

| AUD/JPY | AUD/CHF | NZD/JPY | GBP/NZD |

| GBP/AUD | GBP/CAD | CAD/JPY | NZD/CAD |

| NZD/CHF | USD/CNH | USD/HKD | USD/SGD |

| Exotic pairs | |||

|---|---|---|---|

| USD/TRY | EUR/TRY | GBP/TRY | ZAR/JPY |

| USD/ZAR | EUR/ZAR | GBP/ZAR | EUR/NOK |

| EUR/DKK | EUR/SEK | USD/DKK | USD/SEK |

| USD/NOK | USD/RUB | NOK/SEK | GBP/NOK |

| GBP/SEK | GBP/DKK | ||

| Metals | |

|---|---|

| XAU/USD | Spot gold |

| XAG/USD | Spot silver |

| XPT/USD | Spot platinium |

| XPD/USD | Spot palladium |

What is a pip?

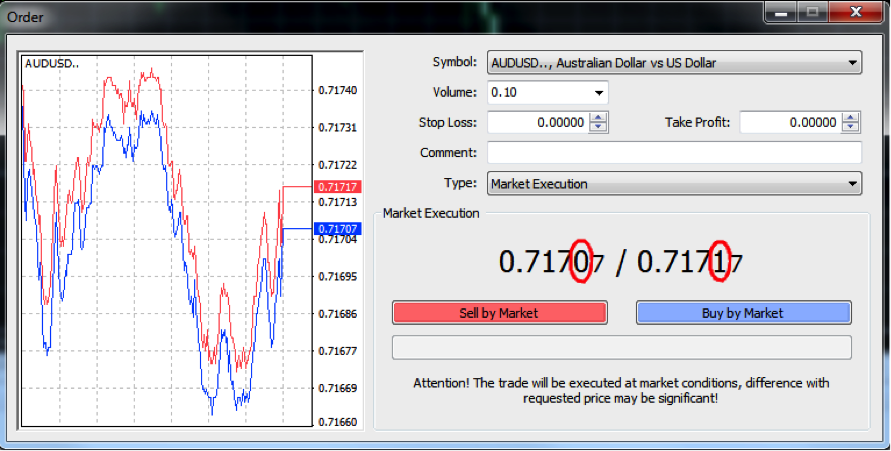

A pip is a small measurement of change in the underlying currency. Generally, it is the forth (0.0001) decimal place of a currency price, except with the Japanese Yen, where they have no denomination for cents in their currency (in the Japanese Yen, the pip is the second decimal place). Shown below is an image representing an order window reflecting the price of the AUD/USD.

The fourth decimal place is circled red to show which decimal the pip is in reference to. If the price 0.71707 moves to 0.71717 then there was a 1 pip movement.

A pip is a good reference measure to how much a trader can make based on the volume of their trades. For example, if a trader purchases a full contract the value of potential return and risk is $10 profit or loss (of the second named currency in a pair) per pip movement. You can follow the table below as a reference to potential risk or return:

| Trade Volume, Lots | EUR/USD US$ per pip | USD/JPY ¥ per pip | EUR/GBP £ per pip |

|---|---|---|---|

| 1.00 | $10 | ¥1000 | £10 |

| 0.10 | $1 | ¥100 | £1 |

| 0.01 | $0.10 | ¥10 | £0.10 |

What is Bid & Ask and spread?

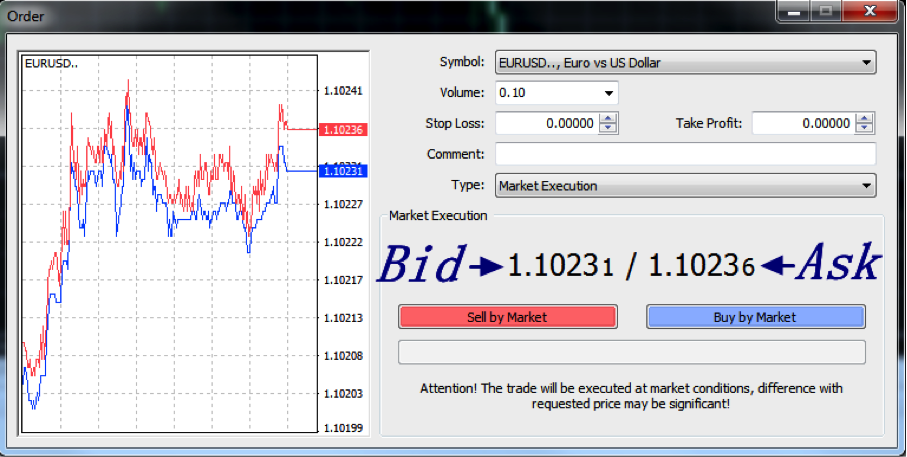

With currency quotes, they are always represented with a Bid offer and an Ask offer. This denotes the price difference between buying and selling.

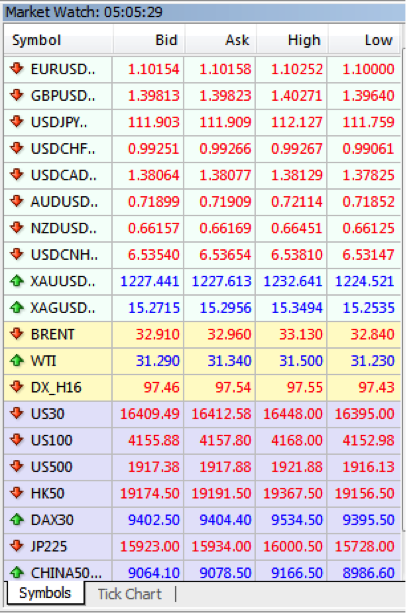

If you BUY, you are buying at the ASK price. If you SELL, you are selling at the BID price. Shown below is a list of currency pairs all showing a Bid and Ask offers.

Remember, if you opened a BUY position and you wish to close it, you are essentially SELLING it back, therefore the price you will be closing the position at is the BID price and vice versa.

The spread is the pip difference between the BID and ASK. If you were to look at the above image and referred to the EUR/USD then you will notice the BID as 1.10231 and the ASK as 1.10236.

This is a spread of 0.5 pips. 1.10236 – 1.10231 = 0.00005 = 0.5 pips

What is leverage and how much do I need to trade?

Leverage is the amount that you are borrowing based on the deposit in your account. Default leverage if is set at 100:1, meaning that for every $1 you have in your account, you have a buying power of $100. If you have $1,000 in your account, you have buying power of $100,000.

Something to remember is, a full contract is 100,000 of the base currency. So if you were looking to trade a Full Lot of the EUR/USD, then you would need the equivalent of €100,000 in your account to trade this with no leverage.

If you wanted to trade a full contract EUR/USD and you had a leverage of 300:1, then you could take this position with only €333.33 in your account (€333.33 x300 = €100,000). High leverage can help you take larger positions based on smaller capital in your account, but it is not without its pit falls. Larger positions result in larger dollar movements per pip and as such can wipe out smaller capital amounts in a short period of time.

Summary

You have now learnt the basics of forex trading. So in summary. If you were to choose a currency pair, say for example the EUR/USD and executed a BUY of 1 full contracts (1.0) at the price of 1.10231.

You would have required a minimum of $333.33 in your account with a leverage of 300:1 to take this position.

The BUY position denotes that if the EUR/USD price appreciates, then you will make money. Say if the EUR/USD appreciates to 1.10240, you have gained 9 pips, which is a profit of US$90.

9 pips x $10 = US$90

MetaTrader 4.The first sign of panic or confusion is as soon as the Meta Trader 4 platform opens maybe it’s foreign and displays a number of charts, numbers, times and currency pairs. Some novices take this opportunity to close the Meta Trader 4 platform, turn off their computer, go to sleep and never return to trading....... ever. Once you have overcome the initial hesitation of opening the Meta Trader 4 platform take the time to have a look at the data available. The market watch window shows current prices for the currency pairs available and the charts give you a timeline based representation of the prices. |

|

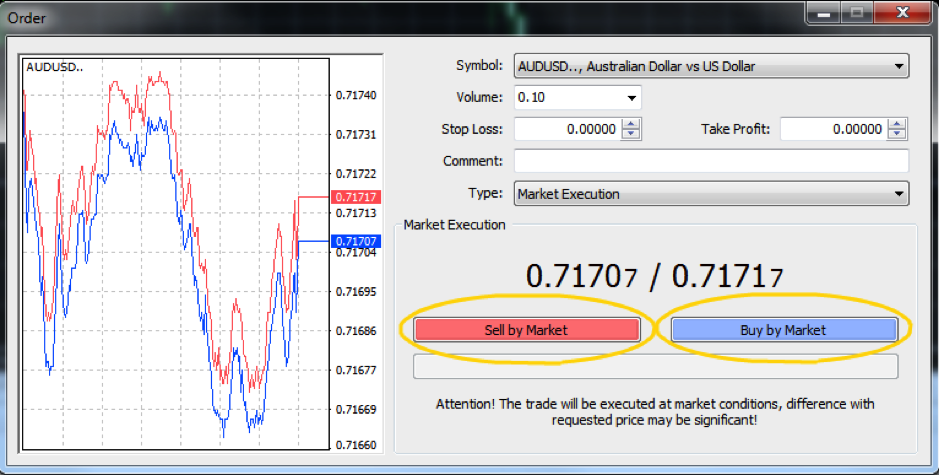

Choose a random currency pair.

Now focus on one particular currency pair. Make a choice, a random one is perfectly fine.

Say for example, you have selected the AUD/USD pair. Open an order window and you will be presented with the option to “buy” or “sell”. We want to make a random trade now, so execute an order to “buy” or “sell” at market.

Place a random trade.

When you see that you have executed a trade, take a moment to watch how it performs. After a break, you will notice that your trade has now either taken a profit, or a loss.

Regardless of the position of this random trade, you now know how you can make money and, also potentially, how to lose it. Don’t worry if your trade took a loss, this was a random trade and the exercise was to place a trade. Choosing the right directions of trading will come later in developing a strategy.

Placed a trade means you have competed the first of learning to trade. You can close this trade if you wish, or you can keep it open and continue to watch it.

How do I read charts?

If you can’t read the charts, then you won’t make sense of any of the data, which to form your strategy.

The charts can be placed in to three different categories:

| 1. | Line Bar Charts |

| 2. | Bar Charts and |

| 3. | Candlestick Charts. |

1. Line Bar Charts

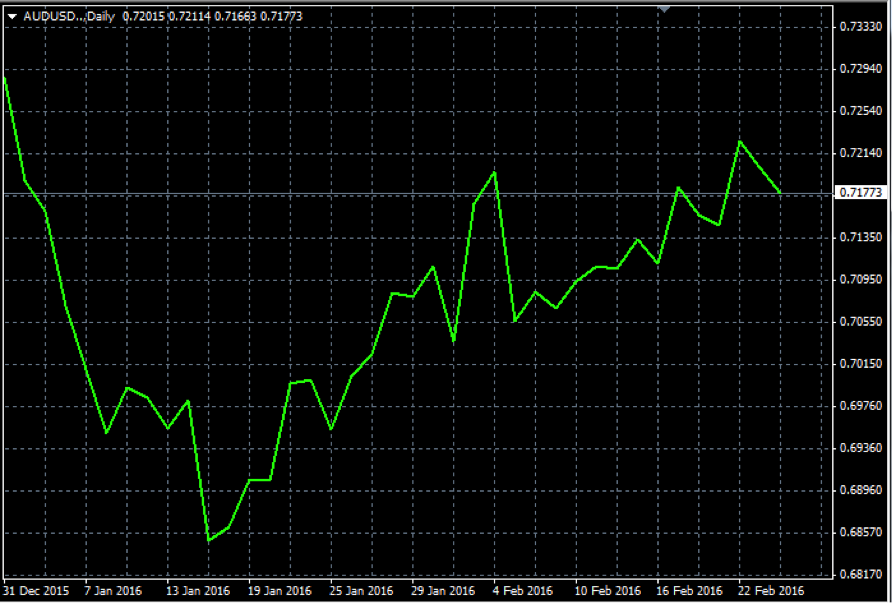

The easiest to read of the charts is the Line Bar Chart. It simply shows a line graph of time vs. price.

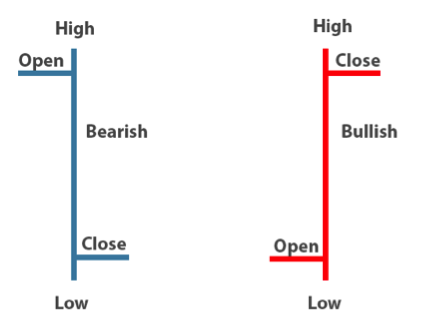

2. Bar ChartsThe next chart to decipher is the Bar Chart. Bar charts not only show price, but also show the entry price per period, the exit price at the end of the period and the high and low of that period. Each horizontal line represents one time period. The period is selected by you to represent 1 minute, 5 minutes, 15 minutes, 30 minutes, 1 hour, 4 hours, a day, a week or a month. |  |

|

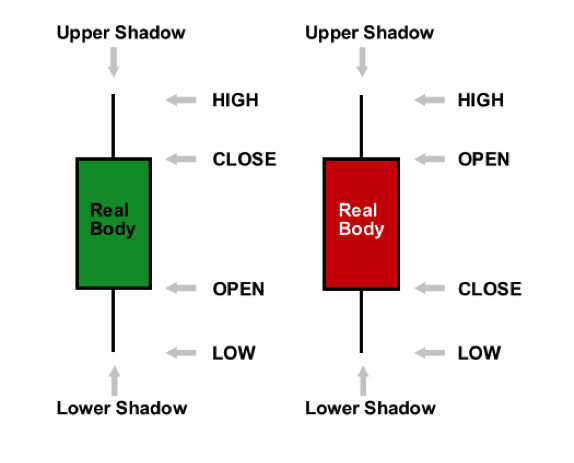

3. Candlestick ChartsCandlestick charts are similar to bar chart but with additional information of each bar being hollow or coloured. This is done to allow a trader to easily visualise a period bar to have moved in a positive or negative direction from its entry price. As shown in the image below, the hollow bars are bars that have moved up. Coloured or filled bars are bars that have gone down. The lines that you see above each bar represent the high and lows. |

When and Why to Buy and Sell?

Having placed some random trades, you would have figured out that when you place an order to buy or sell, you could potentially earn or lose money. The theory is quite simple, pick the right direction and you will make money. The important question is "how do I pick the right direction?".

The simple truth is that if there was a way to know exactly when to buy and sell, everyone would be rich. Simply put, there is no guaranteed way to always pick the right direction the market moves. However, there are a number of tried and tested strategies that you can base your decision on which can increase your chances of a profitable trade.

Strategies are a systematic and planned course of action based on existing information you know of the market. There are multitudes of strategies for Forex Trading. A lot are available to learn for free by doing an Internet search, books available and people that will teach these strategies for a fee. Around the world, professional traders and recreational traders alike will always hold at least one trading strategy to heart and will attribute their success in trading to following that one or many trading strategies. The following section covers some popular strategies that are used by many traders.

The Trending Strategy

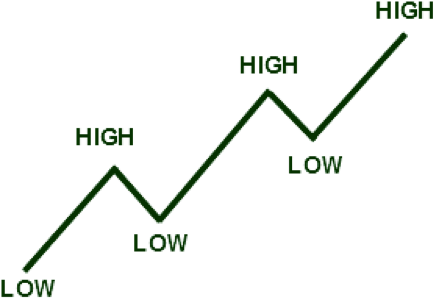

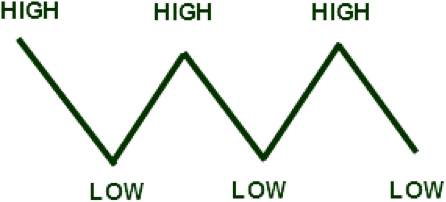

The trending strategy is to follow the market in the direction that it is clearly following over an extended period of time. Currency pairs often take either "bullish" (up) or "bearish" (down) trend.

|

By following the trend of a particular currency pair, you are banking on the fact that the currency continues its existing direction and you are taking in a profit by following the market direction. This strategy is by far the most popular strategy method for trading currency. Trends can be long or they can be short, meaning that there are short-term trends and there are long-term trends. An example would be that during a 6-month period, there was a bullish trend for the NZD/USD, however, in between this 6-month period there were 2 short periods where it took a bearish trend. The following is a graphical representation of the example. If you held a buy position from the start of the 6 months to the end, you would be well in profit. Be careful when you look for your trends. Sometimes when you look at a chart and it shows a very clear trend, if you were to expand your chart to include more data it could very well show you the opposite. As such, if you are looking for trends make sure you view the time frames of all charts. |

The Ranging StrategyThe Ranging Strategy occurs when a currency is trading between a set upper and lower limit and seems to constantly bounce up and down between the high and low limit. Traders take the opportunity to sell when it is at the upper limit and to buy when it is at the lower limit. Represented in the image below, you will see a sideway trend. This marks the opportunity for people who follow a ranging strategy. |  |

The Breakout Strategy

The Breakout Strategy is the break out of a sideway trend. Usually, momentum is greatest on breakout points. A lot of traders take advantage of the breakout strategy when sideways moving prices break the upper or lower limits.

Below represents a few breakouts following some periods of sideways tending.

News Release Trading Strategy

News traders trade off economic news release. The Forex market is particularly reactive to economic news, in particular, interest rate news from the G8 countries, as well as unemployment news for each corresponding country.

News traders will have to bear in mind that the Forex market movements have already taken in to consideration existing and expected economic news. The sharp movements you see due to economic news are corrections due to unexpected news, either better than expected or worse than expected.

Another consideration to take to heart for potential news traders is that during negative sentiment news reports, currency movements generally head towards lower yielding and perceived "safer" currencies; USD and JPY in particular.

A good grasp of economics is generally recommended for traders wishing to start news releasing trading.

Managing your money by managing your risk

Trading the Forex market can be profitable, however, it can be just as costly without the proper management over your capital. Generally with each trade, stop losses are placed to ensure that a trade that goes against you does not completely devour your invested capital.

A stop loss is a preset target where your trade will close out. Setting proper stop losses are important to ensure that your losses are minimized. For traders that don’t want to sit in front of their computer every minute they have positions opened, stop losses are your best friend.

Setting the amount you are willing to lose per trade is subjective. Generally, risk levels are set at between 1% and 5% of your trading accounts total balance. This means at a risk level of 5%, you can place 20 losing trades before you lose all your funds. If you find that you often lose 100% of your funds, you may wish to back track on your strategy.

Say for example, you deposited an initial amount of $1,000. To risk 2% per trade would be to set a stop loss which will close the trade for you should a single trade lose $20 ($1,000 x 2% = $20).

Make sure that you manage your risk, as this is one of the critical aspects in long-term trading success.

Trading Psychology

Managing your emotions

Quite often, the greatest opponent you have while trading is not the market but yourself. When trading, greed and fear often limit the potential returns from profiting trades and on the opposite side of the spectrum can result in greater losses than necessary or turn potentially profitable trades in to losing trades.

All traders (successful and unsuccessful) can attest to holding on to losing trades for far too long for no other reason than the “hope” that they become positive again. This is otherwise known as being too greedy.

Alternatively, the fear of taking profits too early or closing at a small loss when they can potentially be profitable is also another emotional response that needs to be adjusted. Good traders strictly follow a complete trading plan that incorporates money and risk management, entry, exit rules and do not let emotions influence their trading.

When do I move from demo to a live account?

The important move to using a live trading account rather than a demo trading account is a question that is often asked by many new traders. Most important is that you have a strategy in place, once you have become comfortable with a strategy or a few strategies that you have tried, you are encouraged to move to a live trading account

.As great as demo accounts and “virtual money” is for learning, all too often an emotional detachment is developed to the trading loses with play funds and you will never develop the keen senses to close out losing trades. It’s all too often that serial demo users lose their account balance and continue to deposit remarkable sized amounts of funds. In reality, $10,000 is very hard to replace for most people.

Once you feel you have a comfortable grasp of strategy, control over your emotional misgivings to trading, you can begin your live trading with read funds and expect real returns in profit.

Get in touch

Pacific Financial Derivatives LLC.

Product Inquiries and Live Chat PFD provides continual 24-hour support from 05:00 PM Sunday New York time through to 05:00 PM Friday New York time.